How to get great Health Insurance if you are Self-Employed

Having health insurance is imperative. When you are self-employed getting access to affordable health insurance can be impossible. The common theme is that Health Insurance is expensive, but not having Health Insurance is even more costly.

However, you do have options and we will detail all of them for you here. Your three best options are Association Plans, Professional Employer Organizations (PEOs), and Employer of Record (EOR) solutions.

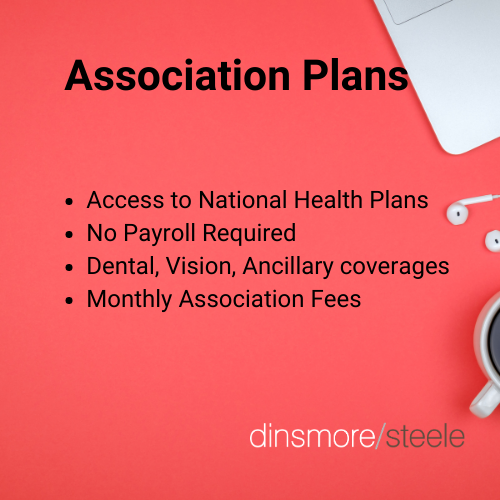

Association Plans

Association Plans are a great solution. You join the association, and as part of being a member of the association, you can partake in the Association’s Medical Plans. The Association does require Personal Health Questionnaires, which provide insight into your health and wellness.

The Association can accept or decline coverage on their plans based upon your health. It is solely their decision. However, if you are accepted, the rates are lower than the open market and they use National carriers like Aetna, Cigna, BCBS, and UHC.

You can also enroll in dental, vision, disability, GAP plans, and other Ancillary plans.

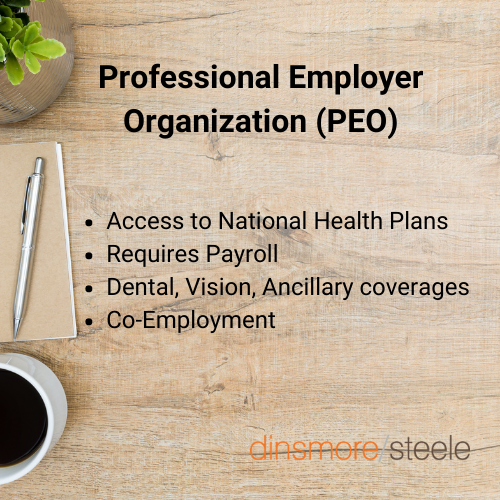

Professional Employer Organization (PEO)

Professional Employer Organizations offer a full-service solution for you, including health insurance. A PEO requires you to do your payroll with them, so if you have no employees, you would pay yourself as an employee through the PEO.

Being in a PEO gives you access to the PEO’s Health Insurance Plans, which gives you access to National carriers - Aetna, BCBS, Cigna, UHC, Oxford, and regional carriers like Kaiser Permanente and Tufts. The PEO also does your Workers’ Compensation and offers 401-k.

Because of Co-Employment, you are actually co-employed by the PEO and yourself. So the PEO pays your taxes to State and Federal governments for your FICA, FUTA, and SUTA.

Just like Association Plans the PEOs offer a full array of Ancillary benefits.

Employer of Record (EOR)

Employer of Record (EOR) is a third-party organization that hires and pays an employee on behalf of another company and takes responsibility for all formal employment tasks. An EOR option works similarly to a PEO.

An EOR offers benefits as well from National Carriers such as Aetna, BCBS, Cigna, UHC, and Oxford. The EOR also processes your payroll, so if you have no employees, it would require like the PEO for you to pay yourself through the EOR provider.

EORs also give you options for Ancillary insurances as well.

So what do you do?

Great question, the best advice is to take a look at all three, and then decide what you would like to do. As a general rule, Association Plans are less overall cost and do not require Co-Employment or processing payroll.

PEOs and EORs both require you to process payroll but are full-service solutions that can grow with you if you end up hiring employees.

If this all seems like a lot of work, it can be. Schedule a call with us, and we will help you sort it all out.