Don't be stupid. Use a PEO Broker.

If you wanted to, could you actually build your dream home? You'd need to create a design for an appropriate site (with approval), then set the foundation. Rough framing follows, then installing inner-workings like plumbing and electrical with a series of inspections along the way. Insulation and drywall prepare each room for a variety of fixtures and finish work as roofing and siding secure the outside. There are 1,001 steps throughout that process, each of which costs a significant amount of time and money.

Could you evaluate and compare all the different parties for each stage of construction, each of whom offers unique expertise, to get exactly what you needed at a price within your budget? Probably not, unless you were willing to dedicate years of full-time work to acquiring the necessary knowledge and experience, and then years more to administer the whole process yourself.

If you were concerned about efficiency, cost savings, and ensuring that it turned outright, you'd hire a general contractor to identify your needs and match them with the best subcontractors for the job.

Finding the right Professional Employer Organization is a lot like building a house. There are over 700 PEOs to choose from. Some are great matches; most won't be the right fit. How can you decide which PEO service offers what you need at the best price? You have two options: do it all yourself or work with a PEO broker who can set you up with the right PEO.

Complete One Form versus several

To give an accurate quote for the appropriate services, a PEO needs a host of information from the business owner -- employee salaries, insurance policies, employee benefits, workers' comp, employee health insurance, general health care requirements, workers' compensation history, and more.

Unfortunately, each PEO uses its own proposal system, so there isn't a standard packet to fill out for all of them. Every time you request a proposal from a different PEO, you'll need to submit your company's information in a unique format.

The PEO consultant might not issue a quote, or the quote will be too high or a poor fit. Going through that process just to yield an unsatisfactory result gets expensive fast.

Instead, you can submit that information just once to a PEO broker who will then evaluate it to narrow down the PEOs that fit best -- that's faster, cheaper, and more effective.

PEO Brokers Have Leverage

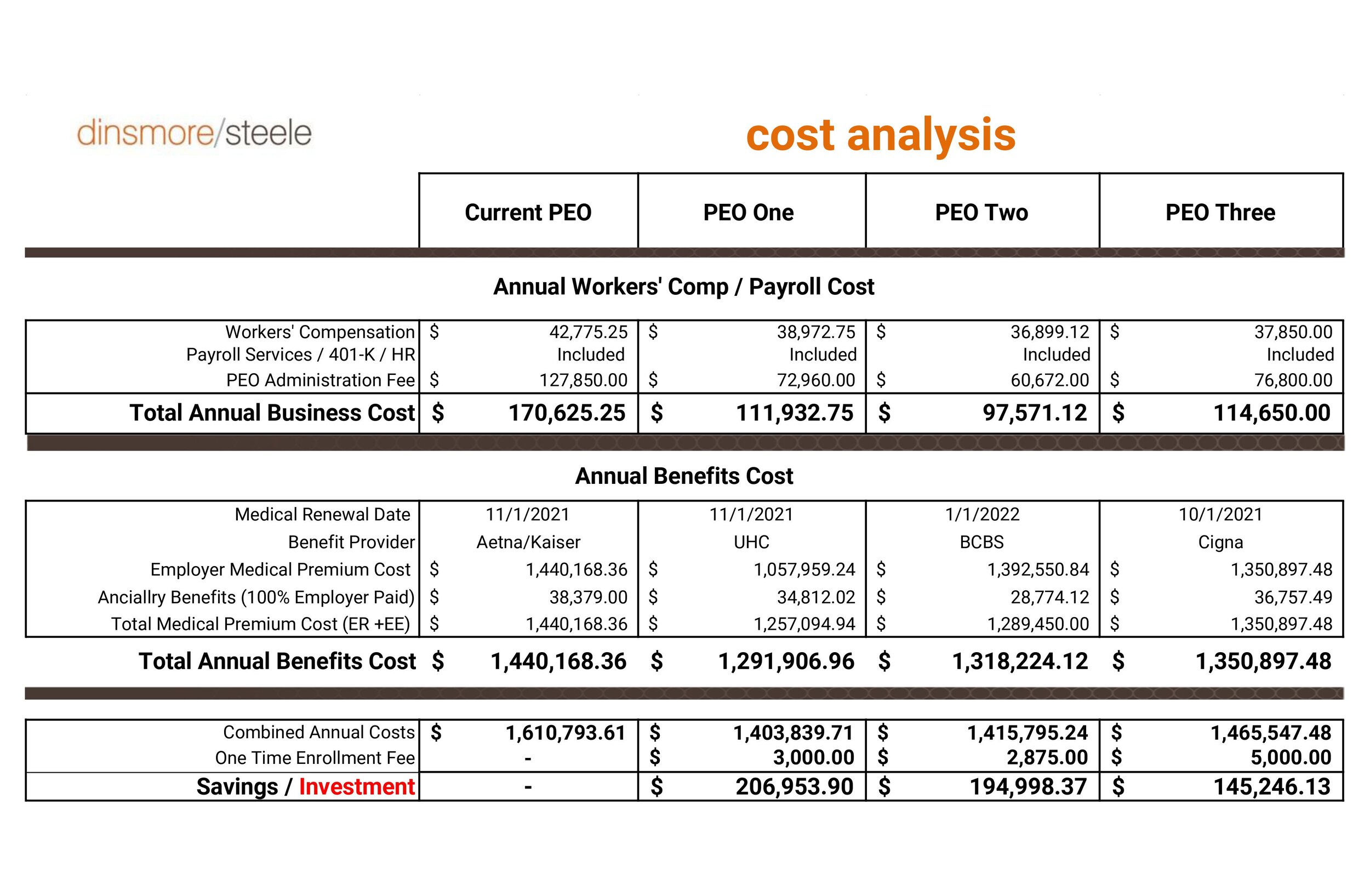

PEO brokers can compare proposals in different formats to evaluate how they do (or do not) meet your needs. It's what they do.

But they can also use their relationships with PEOs to negotiate better rates. In the end, you're the consumer; you'll get the best prices when providers compete for your business. A PEO broker acts as an advocate for you in dealing with PEO companies to find the right services at the highest value.

PEO Brokers Have a Vested Interest in the Outcome

When you deal with a PEO yourself, a sales associate is trying to convince you to work with that particular PEO. This is not to say that those who work in PEO sales are dishonest, but they aren't neutral parties. They want you to be their customer, so it can be difficult to separate the benefits they laud in the sales process from the realities your company will face.

A PEO broker has a different perspective -- they want to match you with the right PEO, and they have an interest in a successful outcome that includes both the PEO and your company being happy.

We're increasingly in a reputation-driven economy, and service providers depend on referrals from satisfied customers. Few things are more convincing than someone you trust endorsing a business relationship, and few are more destructive than a negative testimonial. PEO brokers need customers to be paired with a PEO that's a good fit on price, services, and value. They need a positive outcome as much as you do.

DIY At Your Own Peril

PEO brokers are a terrible fit for some companies. If you want to go through a lengthy process that will spread your company's information far and wide, drown you in a sea of proposals and leave you to evaluate the veracity of a hundred different sales pitches, a PEO broker isn't the right choice (he'll only simplify things).

But that's probably not you. You're looking for a PEO expert to handle the benefits, payroll, workers compensation, and human resources so you can focus on your company's product or service. A PEO broker is the first step in that process. By harnessing their knowledge and relationships with an ever-growing number of providers, a PEO broker can work with you to find the PEO that fits best -- and do it as efficiently as possible.